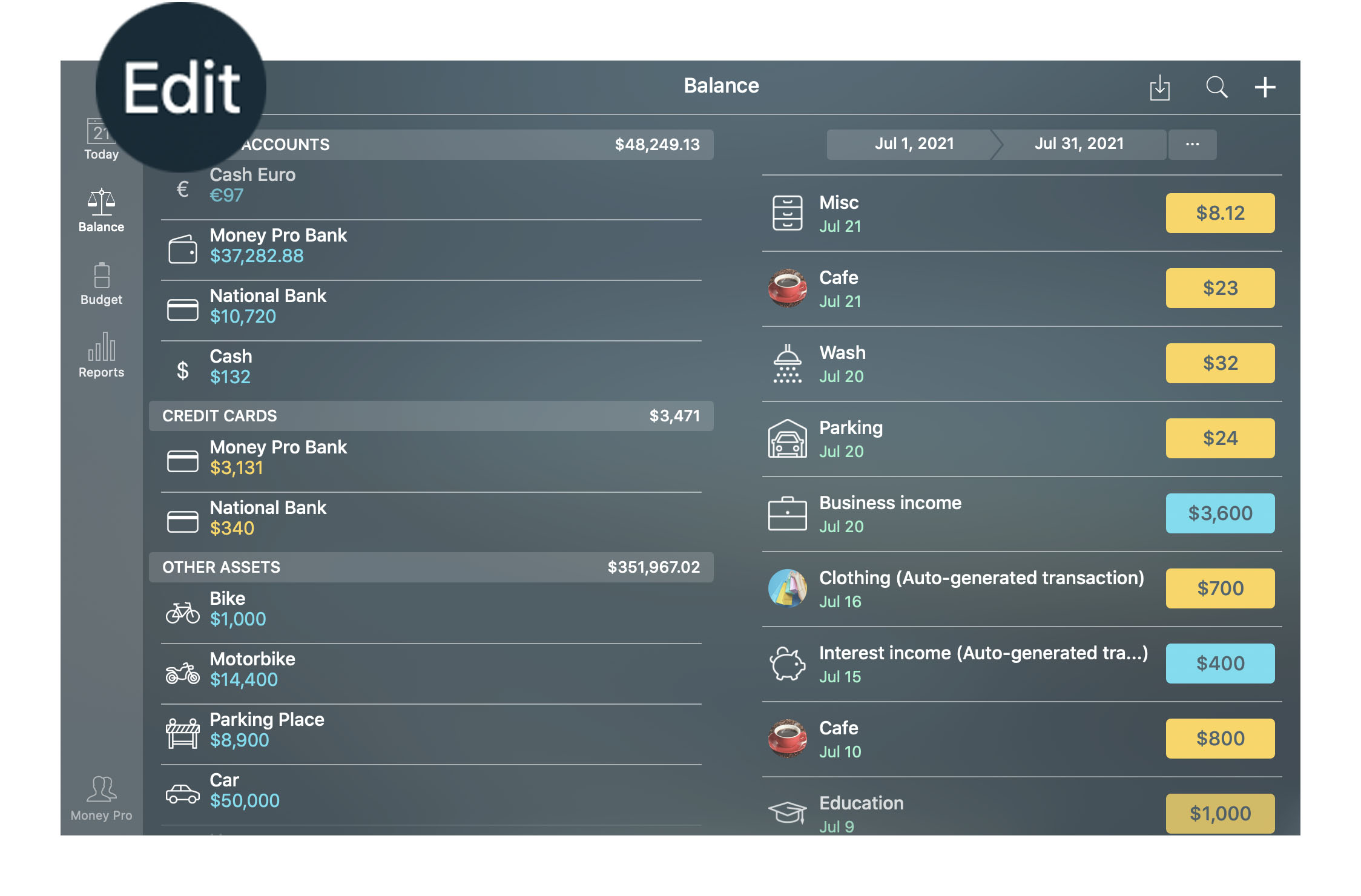

Open the Balance tab, tap/click “Edit” > “Add” > “Online Banking”.

Money guide pro manual#

Online-Banking allows connecting Money Pro to your bank to sync your transactions which will significantly reduce your manual entries. Online Banking (requires GOLD subscription)

Money guide pro mac#

Once you make the desired order on your iOS device, you’ll be able to transfer it to the Mac app by syncing. Please note that you can change the order of the accounts only within a particular class (Payment Accounts, Credit Cards, etc.).

Repeat this operation with other accounts as well.Tap and drag the three stripes icon of the needed account to the right place in the list of your accounts.It can be called an account mobility icon. There is an icon of three stripes to the right of each account.The new appeared screen structures the accounts by classes: Payment Accounts, Credit cards, and Other Assets, Other Liabilities.On the Balance tab, tap «Edit» in the upper right corner,.You can sort the accounts alphabetically or according to your desire. There are some useful add ons also available as per your client’s need.Hint! If you tap/click any of your accounts, you will see its transactions list. The cost of Money Guide ( Pro version) is $125 per advisor paid monthly/annual subscription.

Money guide pro software#

There are so many more features of this amazing software which you’ll know once you use it. Class Sensitivity Stress Test shows Plan Results if one or more asset classes get lower than expected returns.Bad Timing Stress Test shows Plan Results with “low returns” in one or two years.What If Plans allow new investments or retirement incomes.Each What If Plan allows assumption changes in rates of return, inflation, goals, and savings.Extensive what if capability allows for different scenarios, quickly and easily.Capability to see results for one goal or multiple goals combined.Allows unlimited other retirement Income Sources (pension, alimony, rental, part-time work, etc.).Allows for change in state of residence, which affects state taxes.Allows fixed expenses (e.g., no inflation).Realistic life expectancy default calculation.Identifies alternate funding sources (loans, scholarships, etc.) used to offset costs.Includes Peterson’s college cost database.Includes average estimates for public, private, 2-year, and 4-year schools.Can include one child or all children in a plan.Flexibility in assigning assets to specific goals, using assets in priority order, or both.Funds goals in priority order, which may be different than chronological order.Either single or multiple Goals can be in a plan.Simple enough for clients to use, sophisticated enough for the range and complexity that advisors need in comprehensive financial plans.

Overall planning: One version of the system is for both advisors and clients. You can create Financial Plans (goal-based planning, including risk management), Asset Allocation Plans, and Lifetime Income Plans.Ī few of the features of Money Guide Pro are:ġ. The tool is desirable to focus on financial goals, such as retirement. MoneyGuidePro’s financial planning software is used by over 40% of financial advisors according to a software survey by T3. Clients come with a thorough googling of what’s happening in the world so yeah they are pretty much aware of the advancements that have happened over the years.Īnd you don’t want to lag behind. Financial advisors need this tool now more than ever. With recession coming every now and then, it has become absolutely essential to keep track of your finances.īut obviously this tool is not just for everyone. It is never too late to understand the importance of financial management. *not a sponsored post* Why do you need Money guide pro Financial planning tools have become more important than ever. Money guide pro is a software company for financial planning, in simpler terms.

0 kommentar(er)

0 kommentar(er)